Frontclear has developed a visible and trusted position as thought leader in money market matters.

mediareleases

Frontclear and Parallax Valores S.A. close a Latam market first repo against USD-denominated collateral through the Tradeclear platform1 July 2025

FMDQ Group and Frontclear Deepen Strategic Partnership to Promote Cross-Border Money Market Transactions24 June 2025

Frontclear arranges an ISDA-documented landmark local currency cross-border repo transaction with State Bank Mongolia13 February 2025

Frontclear and Banesco Banco Múltiple, S. A. close a market first GMRA documented cross-border DOP repo against DOP-denominated collateral

also available in Spanish31 July 2024

frontclearnews

Strong capital and liquidity levels leave DR banking industry in rude health1 November 2024

Investec, Frontclear launch “first of its kind” trade finance facility for African SMEs19 March 2024

Bank of Botswana, ECA, and Frontclear strive to create a dynamic interbank money market5 December 2023

Frontclear represented by its CFRO Mr. Erik van Dijk and the Bank of Botswana represented by Dr. Kealeboga Masalila, signed an MOU formalizing a shared commitment to support the country’s interbank market development. The MOU details a 4-part technical assistance programme including a Money Market Diagnostic Framework (MMDF), legal and regulatory review and reform, Tradeclear Feasibility, and wide-scale market training. The first activity is the kick-off workshop on the Money Market Diagnostic Framework (MMDF) held in Gaborone on 5 December 2023, attended by more than 40 persons from the central bank, commercial banks, the SADC and IMF. The MMDF is made possible with the financial support of the UNECA.

Netting Workshop for Central Bank Partners15 November 2023

research

Bond Market Governance and Oversight. Frontclear Policy Brief #331 December 2021

Defining Interbank Impact Indicators. Frontclear Policy Brief #224 November 2021

Towards Recovery and Resilience. Frontclear Policy Brief #126 April 2021

GMRA Handbook. Frontclear Study #430 July 2024

Interbank Indicators Study. Frontclear Study #32 February 2021

Rough Guide to the GMRA 2011. Frontclear Study #24 October 2018

library

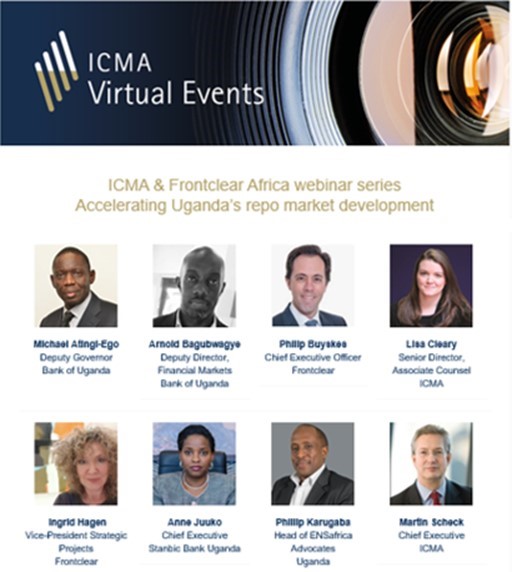

Accelerating Uganda’s repo market development11 February 2021

Accelerating Ghana’s repo market development25 November 2020

Debt capital markets in Africa – developments and challenges28 October 2020

| Fitch | A- | Stable Outlook | Fitch A- Stable Outlook (IFS – Insurer Financial Strength Rating) | link to press release |

| Moody’s | Baa1 | Stable Outlook | Moody’s Baa1 Stable Outlook (IFSR – Insurance Financial Strength Rating) | link to press release |